Volkswagen Group with solid FY 2024 results and a robust outlook

“In 2024, Volkswagen Group has set a decisive strategic course. With innovative, emotional products. With trailblazing strategic decisions. In 2025, we will continue to focus on consistent implementation. As our transformation gains in traction, the new strength of Volkswagen Group comes to life. Our continuing model offensive, regionally tailored products for our markets around the globe and strong partners constitute the basis for sustainable positive development. With the ramp-up of affordable e-mobility, our autonomous vehicle fleet and the battery cell production in Germany, Volkswagen is showcasing European innovation for the world – as the global automotive tech driver.”

“In a challenging competitive environment, we achieved a decent overall financial performance in 2024. Our outlook reflects the global economic challenges and the profound changes that are happening in the industry. We keep combustion engines technologically competitive, we are simultaneously investing in electric models and software, and we continue to strengthen our regional presence – with a clear growth and investment strategy in the US. To achieve this, it is crucial that we continue to offer our customers highly attractive vehicles, while consistently reducing costs and increasing profitability. This will be our focus in the coming months and years.”

Dividend

The Board of Management and Supervisory Board are proposing a dividend of EUR 6.30 per ordinary share and EUR 6.36 per preferred share to the Annual General Meeting, representing a decrease of 30 percent compared to the previous year’s figures. The payout ratio corresponds to around 30 percent.

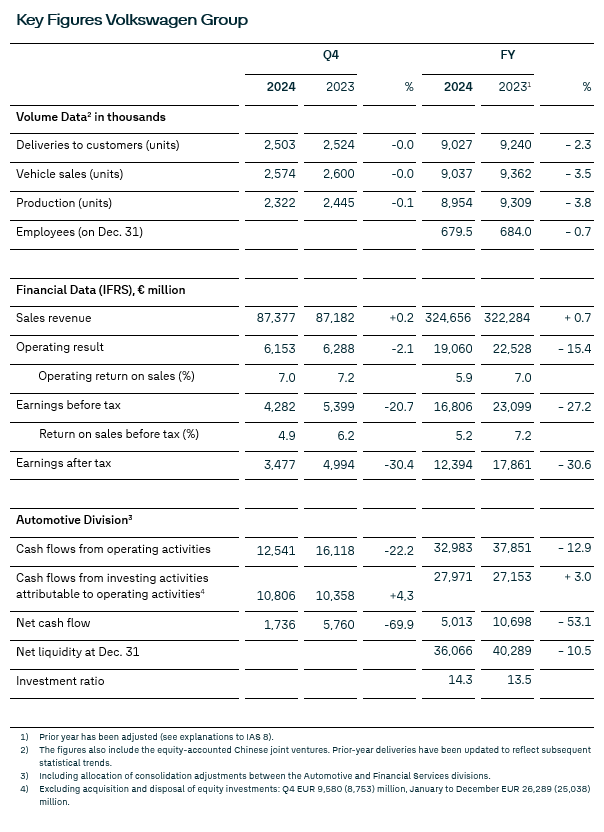

Outlook for 2025

The Volkswagen Group expects the sales revenue to exceed the previous year’s figure by up to 5 percent. The operating return on sales for the Group is expected to be between 5.5 and 6.5 percent.

In the Automotive Division, the Group expects an investment ratio between 12 and 13 percent in 2025. The automotive net cash flow for 2025 is expected to be between EUR 2 and EUR 5 billion. This includes cash outflows for investments for the future as well as for restructuring measures from 2024. Net liquidity in the Automotive Division in 2025 is expected to be between EUR 34 and EUR 37 billion. It remains the group’s goal to continue its robust financing and liquidity policy.

Challenges will arise in particular from an environment characterized by political uncertainty, increasing trade restrictions and geopolitical tensions, the increasing intensity of competition, volatile commodity, energy and foreign exchange markets, and more stringent emissions-related requirements.

Note: Adjustments to the reporting logic from January 2025 will lead, among other things, to a more precise disclosure of the Automotive Division's sales revenue. In mathematical terms, this will lead to a lower investment ratio, namely by 130 basis points to 13.0 percent in the 2024 financial year.

Based on the adjusted reporting logic, we expect the investment ratio in the Automotive Division to reduce to between 12 and 13 percent in 2025 and to around 10 percent in 2027. For details, see page 180 of the 2024 Annual Report.