Volkswagen Group delivers solid results in challenging environment

“Driven by the success of our new products, Volkswagen Group held its ground in an extremely challenging environment. We made noticeable improvements in design, technology, and quality, and achieved significant progress in software. Our sales figures remain stable in a competitive global market. In Europe we expanded our leading position in electric mobility, with a market share of 28 percent and order books remain well filled. Supported by our ongoing product offensive and consistently good demand, we expect the positive trend to continue in second half of the year.”

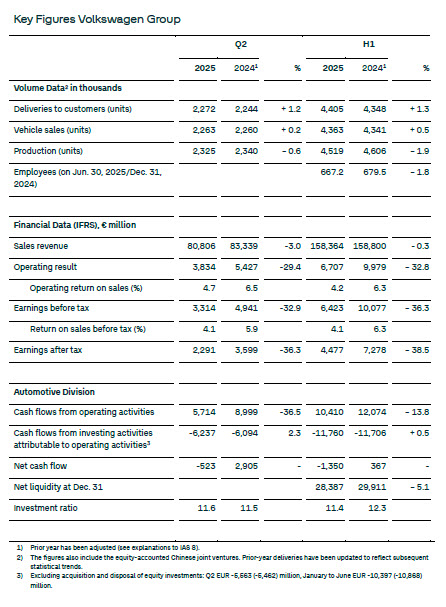

“Our half-year figures present a contrasting picture: on the one hand, we achieved strong product success and made progress in realigning the company. On the other, the operating result declined by a third year-on-year – also due to higher sales of lower-margin all-electric models. In addition, increased US import tariffs and restructuring measures had a negative impact. Excluding these items, the operating margin in the second quarter is at nearly seven percent, representing the upper end of our expectations. This shows that we are on the right track. But what really matters is cash in the bank. That’s why we must press ahead with our ongoing programs to improve earnings and pick up the pace where necessary.”

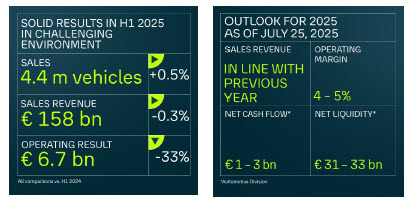

Outlook for the year 2025 as of July 25, 2025

The Volkswagen Group expects sales revenue to be in line with the previous year’s figure (previously: increase of up to 5 percent). The Group’s operating return on sales is expected to range between 4.0 and 5.0 percent (previously: 5.5 to 6.5 percent).

In the Automotive Division, the Volkswagen Group continues to expect an investment ratio between 12 and 13 percent in 2025. Automotive net cash flow for 2025 is expected to be between EUR 1 and EUR 3 billion (previously: EUR 2 to EUR 5 billion). This includes cash outflows for investments for the future as well as for restructuring measures. Net liquidity in the Automotive Division in 2025 is expected to be between EUR 31 and EUR 33 billion (previously: EUR 34 to EUR 37 billion). The Group continues to pursue its objective of maintaining a solid financing and liquidity policy.

At the lower end of the forecast ranges for operating result, net cash flow and net liquidity, it is assumed that in particular the current US import tariffs of 27.5 percent will continue to apply in the second half of 2025; at the upper end, it is assumed that these tariffs will be reduced to 10 percent. There is high uncertainty about further developments with regard to the tariffs, their impact and any reciprocal effects.

Challenges will arise in particular from an environment of political uncertainty, expanding trade restrictions and geopolitical tensions, the increasing intensity of competition, volatile commodity, energy and foreign exchange markets, and emissions-related requirements that have been more stringent since the beginning of the year.

Note: Adjustments to the reporting logic from January 2025 will lead, among other things, to a more precise disclosure of the Automotive Division’s sales revenue. In mathematical terms, this will lead to a lower investment ratio, namely by 130 basis points to 13.0 percent in the 2024 financial year. Based on the adjusted reporting logic, we expect the investment ratio in the Automotive Division to reduce to between 12 and 13 percent in 2025 and to around 10 percent in 2027. For details, see page 180 of the 2024 Annual Report.