NEW AUTO: Volkswagen Group set to unleash value in battery-electric autonomous mobility world

Volkswagen presented its plan for transforming the Group into a software-driven mobility company with a strong focus on its powerful brands and global technology platforms, providing synergies and scale as well as opening up new profit pools. “We set ourselves a strategic target to become global market leader in electric vehicles – and we are well on track. Now we are setting new parameters,” said CEO Herbert Diess during the presentation of NEW AUTO, the Group’s strategy through 2030. “Based on software, the next much more radical change is the transition towards much safer, smarter and finally autonomous cars. That means for us: Technology, speed and scale will matter more than today. The future of cars will be bright!”

Volkswagen Group is setting new priorities to leverage the opportunities arising from the electric and digital era of mobility, with sustainability and decarbonization as integral parts of its new strategy.By 2030, the Group plans to reduce its carbon footprint per car by 30% over its lifecycle (vs. 2018), in line with the Paris Agreement. In the same timeframe, the share of battery-electric vehicles is expected to rise to 50%, while in 2040, nearly 100% of all new Group vehicles in major markets should be zero-emission. By 2050 at the latest, the Group intends to operate fully climate neutral.

Profit and revenue pools are expected to shift gradually from internal combustion engine cars (ICEs) to battery-electric vehicles (BEVs) and then to software and services, boosted by autonomous driving. The ICE market is set to decline by more than 20% over the next 10 years. In parallel, BEVs are projected to grow rapidly and overtake ICEs as a leading technology. At an estimated €1.2 trillion, by 2030, software enabled sales could add around one third on top of the expected BEV and ICE sales, more than doubling the overall mobility market from around €2 trillion today to a projected €5 trillion. Individual mobility, based on cars, is expected to still account for 85% of the market and Volkswagen’s business.

A robust-margin ICE business, generating strong cash-flows will finance and accelerate the shift to BEVs. A disciplined ramp-up driven by synergies from lower battery and factory costs and increasing scale is expected to improve BEV margins. Higher CO2/Euro 7 costs and tax disadvantages will likely further narrow ICE margins. Overall, margin parity should be reached within the next two to three years.

To reflect its new strategic approach, Volkswagen Group raised its ambition level for operating return on sales in 2025: The Group increased the original range of 7‐8% to now 8‐9% as the foundation for its Planning Round 70 in November 2021.

“We intend to install industry leading platforms across strong brands, to be able to have more scale and capture even more synergies in the future”, CFO Arno Antlitz said. “We will scale our BEV-platforms, we want to develop a leading automotive software stack. And we will continue to invest in autonomous driving and mobility services. During this transition, our robust ICE business will help to generate the profits and cash flows to do so.”

Volkswagen has already earmarked €73 billion for future technologies from 2021 through 2025, representing 50% of total investments. The share of investments into electrification and digitalization will be further increased. The Group will also continue to raise efficiency and is on track to meet its 5% fix cost reduction program that it set out for the next two years. Volkswagen is also committed to reducing material costs by another 7% and is optimizing its ICE business with fewer models, a reduced ICE drivetrain portfolio and a better price mix.

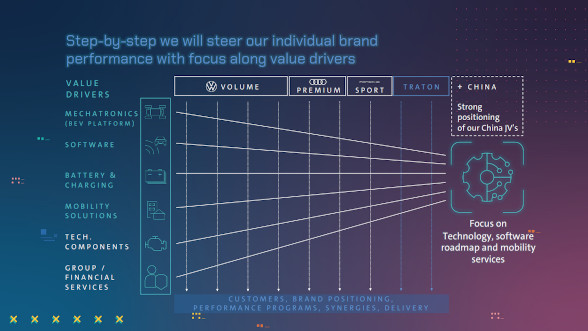

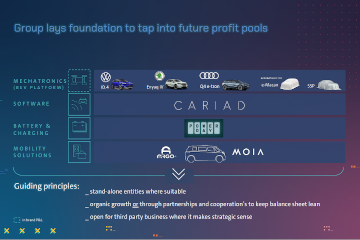

Unprecedented platform model to scale up future technologies

The comprehensive approach across four key technology platforms is meant to allow Volkswagen Group to generate unparalleled synergies for all passenger and light commercial vehicle brands as well, and can also be partially leveraged for trucks. Synergies are expected to arise in many areas: from a universal BEV product architecture to CARIAD’s global software platform, own cell and battery production at scale, all the way to a mobility platform that bundles a range of services seamlessly.

Mechatronics – Enabler for growing portfolio of software services

The SSP (Scalable Systems Platform) as Volkswagen Group’s next generation mechatronics platform will significantly reduce complexity over time. As the successor of MQB, MSB, MLB, as well as MEB and PPE, it will extend the consolidation from three ICE-platforms to two BEV-platforms, to finally one unified architecture for the whole product portfolio. From 2026 onwards, the Group plans to start the production of pure electric vehicles on the SSP. This next generation will be all-electric, fully digital and highly scalable. Over its lifetime, more than 40 million vehicles are projected on this basis. Like the MEB today, the SSP will be open to other auto manufacturers.

To improve and speed up its mechatronics platform competencies, the Group will invest around €800 million into a new Research & Development facility in Wolfsburg, where the core of the SSP platform and its modules will be designed.

Markus Duesmann, CEO of Audi, said: “Introducing the SSP means leveraging our strengths in platform management and building on our capabilities to maximize synergies across segments and brands. In the long run, our SSP will significantly reduce complexity in mechatronics. Thereby, it is not only a central premise to lower CAPEX, R&D and unit costs compared to MEB and PPE and to enable the Group to reach its financial targets. It particularly is the enabler to manage future challenges in vehicle development, as cars become more and more software-oriented.”

Software – Seamless, global software platform to enable intelligent and autonomous driving

Software will enable the seamless integration of NEW AUTO into the customers’ digital lives and deliver even higher economies of scale. Volkswagen Group’s automotive software company CARIAD aspires to develop the leading software platform by 2025, as one software backbone for all group cars. Currently, the entity is working on three software platforms: E³ 1.1 allows for upgrades and over-the-air updates of the MEB product portfolio, such as the Volkswagen ID.4, the Skoda Enyaq or the CUPRA Born. In 2023, CARIAD will release the premium software platform 1.2 (E³ 1.2): It will enable a variety of functions including a new unified infotainment system and over-the-air updates for Audi und Porsche vehicles. In 2025, CARIAD plans to launch a new unified, scalable software platform and end-to-end electronic architecture:

The software stack 2.0 (E³ 2.0) will include a unified operating system for vehicles from all Group brands. Another key feature will be level 4 readiness, meaning that customers can hand over the steering fully to the car.

“Software plays the decisive role in the transformation from a pure car company to an integrated mobility group. By 2030, software – on the basis of automated driving – can become a major source of income in our industry”, said CARIAD CEO Dirk Hilgenberg. The new unified 2.0 software platform for on-board connectivity and software to be rolled out throughout the Group with the SSP, will open the way to a completely new ecosystem and thus also to new data-based business models.

Learning from a vast pool of real-time data through always-connected, automated driving, the Group fleet can be continuously updated with new features and services tailored to customers’ mobility needs. The so-called Big Loop Process for millions of vehicles will significantly expand the product lifecycle. By 2030, up to 40 million vehicles across brands will be operating on the Group´s software platforms.

Battery & Charging – Infrastructure as key to maximizing the “NEW AUTO” potential

Proprietary battery tech, charging infrastructure and energy services are key success factors in the new mobility world. Therefore, power will be a Volkswagen Group core competency by 2030, with the two pillars “battery cell and system” and “charging and energy” under the roof of the new Group division Technology.

Volkswagen Group plans to establish a controlled battery supply chain by setting up new partnerships and tackling all aspects from raw material to recycling. The goal is to create a closed loop in the battery value chain as the most sustainable and cost-effective way to build batteries.

In order to reach its goal, Volkswagen Group is advancing battery competence and reducing complexity. To that extent, it is introducing one unified battery cell format with up to 50% cost reduction and up to 80% use cases by 2030. Six giga factories in Europe with a total production capacity of 240 GWh by 2030 will help to secure battery supply.

The first location in Skellefteå, Sweden, will be operated by Northvolt AB. Volkswagen Group just invested an additional €500 million in its premium cell partner and works with Northvolt towards starting production in 2023.

For the second location in Salzgitter, Volkswagen Group yesterday signed an agreement with Chinese cell specialist Gotion High-Tech as its technological partner for a start of production in 2025. Together, both partners will develop and industrialize the volume segment of the unified cell in the German plant.

As a third location, Volkswagen Group intends to make Spain a strategic pillar of its electric campaign and is considering to establish the entire value chain of electric cars in that country. As part of a larger transformation program, the localization would secure supply for the planned BEV production in Spain. Volkswagen Group verifies the option for a giga factory together with a strategic partner. In its final expansion stage at the end of the decade, the plant is intended to have a yearly capacity of 40 GWh hours. It is also envisaged that the Group’s Small BEV Family will be produced in Spain from 2025. The final decision will depend on the general framework and state subsidies.

Volkswagen Group also intends to offer customers a one-stop solution from charging hardware to Energy Management Services. Ultimately, the Group plans to build an entire charging and energy eco-system around the vehicle, ensuring convenient charging to customers and opening up further business opportunities. These technologies and services will become a core Volkswagen Group competency.

In addition Volkswagen is to boost public charging infrastructure in Asia, Europe and America building on successful Group initiatives such as CAMS in China or Electrify America in the U.S.

Electrify America today announced plans to more than double its current electric vehicle charging infrastructure in the U.S. and Canada to a total of 1,800 fast charging stations with 10,000 charging points installed by 2025. The expansion will increase the deployment of 150 and 350 kW chargers – the fastest speed available today – and help pave the way for more electric vehicles in North America.

At the same time, the Group has secured new partnerships to provide European customers with convenient charging, i.e. with BP, Iberdrola and Enel. Volkswagen Group and Enel X today announced a joint venture to enhance the electric vehicle uptake in Italy. It will own and operate a high-power charging (HPC) network infrastructure with more than 3,000 charging points of up to 350 kW each across the nation by 2025.

Volkswagen Group will implement an overall of 18,000 HPC points in Europe, 17,000 in China and 10,000 in U.S. and Canada.

Thomas Schmall, CEO Group Components, said: “A Volkswagen-controlled battery supply chain will enable us to have authority over the biggest cost block, offer the best and most sustainable batteries to our customers and secure BEV success. BEVs will become mobile power banks that can be fully integrated in the energy grid through bi-directional charging. This will enable us to generate additional profits from participation in the energy market by 2030.”

Mobility Solutions – autonomous driving will be a game changer

By 2030, Volkswagen Group will also have systems capabilities for autonomous shuttle fleets, owning some of them and expanding its offerings of mobility services and financing. Mobility as a service and transport as a service, fully autonomous, will be an integral part of NEW AUTO. The value chain consists of four business areas: the self-driving system, its integration into vehicles, the fleet management and the mobility platform.

Volkswagen Group is already at the forefront of development of a self-driving system for autonomous shuttles with its strategic partner ARGO AI. CARIAD will develop level 4 automated driving capabilities for passenger vehicles. The Group could thus create the biggest neuronal network of vehicles on the streets worldwide.

With pilot projects in Munich, Volkswagen Group is currently testing the first autonomous buses and is planning to roll out similar projects in other cities in Germany, China and the US. In 2025, Volkswagen plans to offer its first autonomous mobility service in Europe, shortly followed by the U.S. Future profit pools are very promising: by 2030, the total market for mobility as a service in the five largest European markets alone is expected to amount to $70 billion.

In the coming years, one platform is meant to integrate all mobility offerings from the Group and its brands, allowing Volkswagen to capture a significant market share and additional revenue streams. One vehicle fleet covering all different services from renting, subscriptions, to sharing and ride hailing will ensure high availability, occupancy rates and profitability.

Christian Senger, CTO of Volkswagen Commercial Vehicles, said: “By the end of the decade, automated driving will completely change the world of mobility. Together with ARGO AI, we are developing an industry leading self-driving system which will enable us to offer completely new mobility services and autonomous transport services. Volkswagen Group is aiming for a significant market share and additional revenue streams in this important future business.”

Christian Dahlheim, Head of Group Sales, added: “The Volkswagen Group aspires to achieve a strong competitive edge in the field of mobility solutions. We will be able to offer services directly to our customers or cooperate with strong partners, depending on the specific situation in each market. One vehicle fleet for all services will enable us to operate very efficiently. Furthermore, our upcoming mobility platform will integrate all mobility offerings from the Group and our brands and thus maximize customer convenience.”

Europe, China and the U.S. will remain main focus of activities for the Group

Starting from a strong basis in Volkswagen’s two home markets, Europe and China, North America will be the Group’s main focus to grow its market share.

China, where Volkswagen Group is starting as long-standing market leader with high profitability, is expected to play a crucial role for the success of the Group’s NEW AUTO strategy. With the ID.4, ID.6and the upcoming ID. 3, Volkswagen – together with its partners– is rapidly rolling out its electric product portfolio and turning its new key NEV joint venture Volkswagen Anhui into the local hub for the SSP, including a new R&D center currently under construction. The Group will also continue to expand its operations with local skills and capabilities. Already today, around 1,000 software engineers are working for CARIAD in China.

In regard to the U.S. market, there has never been a better point in time for Volkswagen to significantly increase its market share. “The Biden administration’s electrification plan gives us a unique opportunity to start from a better position than the competition, having built up an open charging infrastructure across the U.S. and having invested in the transition towards BEVs in Chattanooga already”, CEO Herbert Diess said. Volkswagen is bringing a wide range of highly attractive BEVs tailored to the U.S. market, like the successful ID.4 and the upcoming iconic ID. BUZZ01. Volkswagen is therefore well positioned to participate over-proportionally from future growth in an electrifying market.

People Transformation under way

With half of Volkswagen Group’s 660,000 employees today deployed in the traditional production of cars, the Group is rolling out a comprehensive transformation program over the next 10 years. The Board of management has been working very closely with the works council to ensure that Volkswagen Group takes its people responsibly through the transition, providing resources for re-skilling to acquire software-based capabilities. Volkswagen has already made its German sites fit for the future, transforming the Group’s components business and turning the plant in Zwickau into an e-mobility hub, with similar transformations planned for its sites in Emden and Hanover.

01. ID. BUZZ: Vehicle is not for sale yet

Galleria